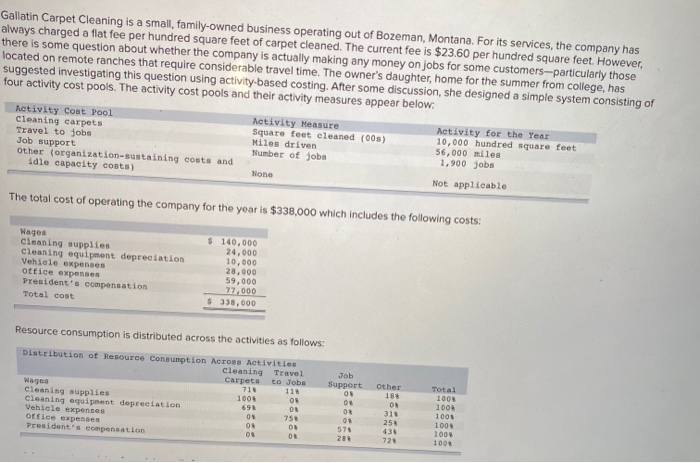

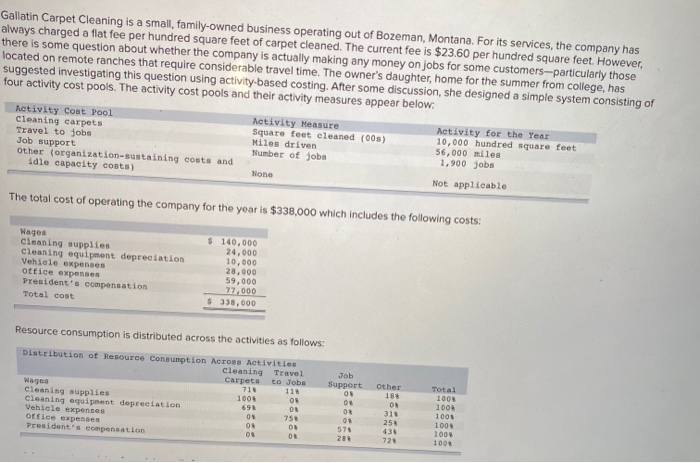

Original cost of carpet.

Depreciation calculator carpet.

10 years 8 years.

Also gain an understanding of different methods of depreciation in accounting or explore many other calculators covering finance math fitness health and many more.

Tip you will depreciate new flooring in a rental over 27 5 years if it is permanent or 5 years if it is easily removed such.

Depreciation calculator carpets rugs the depreciation guide document should be used as a general guide only.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value.

10 years depreciation charge 1 000 10.

This applies however only to carpets that are tacked down.

Percentage declining balance depreciation calculator when an asset loses value by an annual percentage it is known as declining balance depreciation.

Calculate the straight line depreciation of an asset or the amount of depreciation for each period.

Find the depreciation for a period or create a depreciation schedule for the straight line method.

Score 0 0.

Includes formulas example depreciation schedule and partial year calculations.

If your item s asset life is 4 years and the purchase price was 2 000 what is the depreciation rate of the item.

Free depreciation calculator using straight line declining balance or sum of the year s digits methods with the option of considering partial year depreciation.

The depreciation period for flooring depends on the type you install.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

For example if you have an asset that has a total worth of 10 000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9 000.

Property depreciation for real estate related to macrs.

In year 4 calculate depreciation of 16 to reduce the final value to 200.

Like appliance depreciation carpets are normally depreciated over 5 years.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to irs form 4562.

Expected life of carpet.

In year 5 there is no need to calculate depreciation.

Carpet life years remaining.

Depreciation calculator the depreciation guide document should be used as a general guide only.